Maggie's F-W | Our Second Flagship: Maggie's F-W | Savings Bank® | Guest In Training®

Maggie's F-W | Savings Bank® | Guest In Training® Four Pillars:

Rule of Thumb 1:1

One Financial Account: One Student.

OPEN INVITATION TO:

Officials of the Financial Sector in the United States of America

Each of you is invited to join efforts in our most relevant enterprise, in the whole history of the financial education in the United States of America.

Right now, we are Bloomimg our Maggie's F-W | Savings Bank® | Guest In Training® Program: 40+ | 40+ | 40+ | 4+

This plan is focused in provide 40+ millions of Financial Tools to 40+ millions of students in the next 4+ decades.

Our work is to propel those pillars!

The final outcome is portrayed as follows:

Complementary Information: maggiesfwsavingsbank@gmail.com

Our Inspiraration Today

What Is Maggie's F-W | Savings Bank® | Guest In Trainning®?

Maggie's F-W | Savings Bank® | Guest In Trainning® is a marketing program initiated by the Maggie's F-W Company in the United States of America. This program emphasizes the importance of the knowledge of financial skills, as a helping tool for students, to navigate their educational life and beyond. Indeed, Maggie's F-W | Savings Bank® promotes that every student in the United States of America should have, at least, a Savings Acount. This financial tool will help them to achieve their Future Educational Needs, and in some specific cases, to acquire "urgently needed," educational school supplies for themselves.

We Are Welcoming Our Sponsors

These Brand Names are:

INTELLECTUAL PROPERTY (IP):Maggie's F- W | Savings Bank® Product/Service Licensing was created and is owned by Maggie's F- W's Founders.

"JUST ONE SAVINGS ACCOUNT--THE CHALLEGE FOR A NEW GENERATION AND THE OTHERS THAT WILL COME!!!!"

STUDENTS SUPPORT IS NEEDED:

Subscribed banking and financial Institutions will provide the support needed for our children to get, at students own effort, the acquisition of Debt Free Education at all levels of knowledge.

This financial opportunity will provide a safety net to:

103.959 Schools, and within them 3,100.000 + Teachers (National Center for Education Statistics, 2016). Educators that, in fact, will be helping us to achieve this cornerstone.

Thus, this undertaking will support:

50 + Millions of Enthusiastic Students [50.4 million / National Center for Education Statistics, 2016] and at least 100 + Millions of Thankful Parents.

THANK YOU VERY MUCH FOR YOUR SUPPORT!!!!

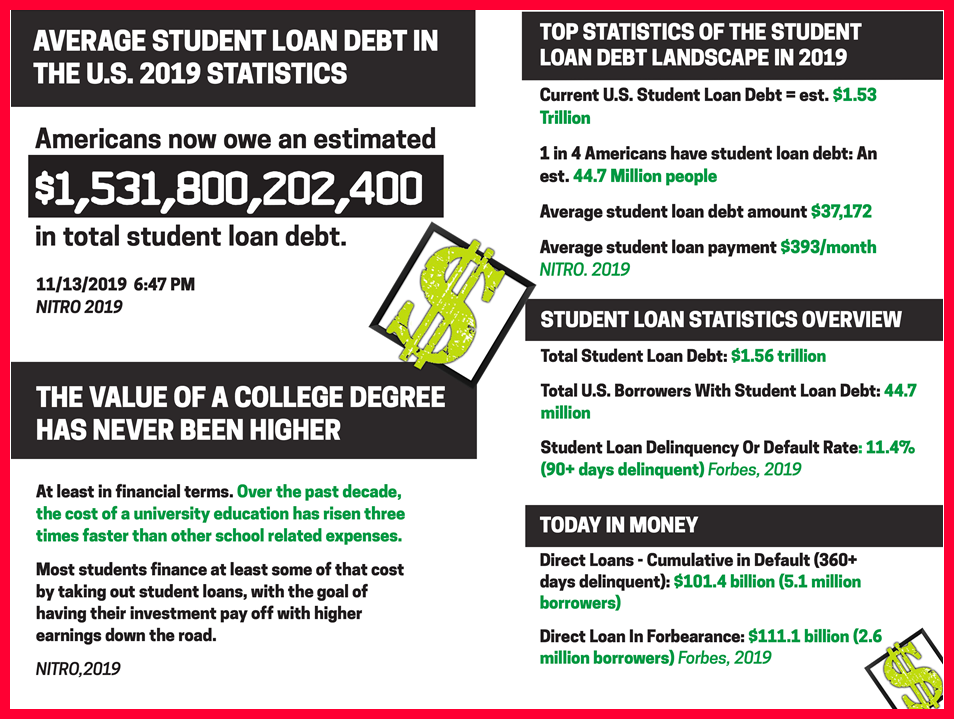

WHY YOUR BANKING SUPPORT IS NEEDED?

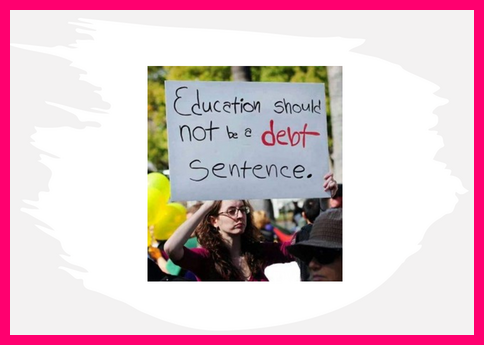

VERY SIMPLE: WE DO NOT WANT THIS BELOW DESCRIBED OUTCOME HAPPENS AGAIN AND AGAIN!!!!:

IMMEDIATE SUPPORT : In response to fight together this aforesaid phenomena, the subscribed banks and financial institutions that agree with this undertaking, will have the opportunity to display, as immediate support, the GUEST IN TRAINING®TELLER WINDOW in each of its brick and mortar banking branches [More or less, as it is displayed below]:

.png)

By the same banks/financial institutions will be offering:

PIGGY-PAPI-BANK®

DOGGIE-MAMI-CARD®

WOOD-CD-PECKER®

MINE ATM®

Bravo!!!!

If you want to learn more about the MAGGIE'S F-W | SAVINGS BANK PRODUCT/SERVICE LICENSING go to: Maggie's F-W (maggiesfw.com)

Waves of Kudos from all of us!!!!

MAGGIE'S FW | SAVINGS BANK®: DEFINITIONS AND REMARKS

ACCOUNT HOLDER: Any student in the United States of America, including [the CNMI (commonwealth of the Northern Mariana Islands), Guam, and Puerto Rico].

USER [LICENSEE]: Any bank and/or financial institution.

MAGGIE'S F-W | SAVINGS BANK®PRODUCT/SERVICE LICENSING: Business license that guarantees the use of one or more products/services for one year only. License is auto renewable every year.

PRODUCTS ( BRAND NAMES):

VENDOR [LICENSOR]: MAGGIE'S FW.

LICENSEE SPECIAL REMARKS:

Important: Additional information is found in Maggies's F-W Services Agreement.

LICENSOR SPECIAL REMARKS:

Important: Additional information is found in Maggie's F-W Services Agreement.

TECHNOLOGICAL/PROPRIETARY TOOLS

Maggie's F-W | Savings Bank® will use the below itemized technological and intelectual-property[IP] tools, to encourage its above mentioned products and services :

First Note: A description of these above-mentioned tools is described, when clicking, in each of them.

INTELLECTUAL PROPERTY [IP]: Maggie's F- W | SAVINGS BANK®Product/Service Licensing was created and is owned by Maggie's F- W Founders.

Second Note -- As informative topics, you can read the following inserts placed at the bottom of this page and/ or click on each hyperlink:

MAGGIE'S F-W SERVICES AGREEMENT

MAGGIE'S F-W | SAVINGS BANK INSTRUCTIONS

MAGGIE'S F-W | SAVINGS BANK FACTS, PURPOSE, AND SIGNIFICANCE

Effective date: This Maggie’s F-W | Savings Bank®-- Our First Flagship is effective and was last updated on May 01, 2024.

Read More

Teaching Children the Importance of Saving Money

Knowledge of financial skills is important in helping you navigate life. Those financial skills involve saving and investing. However, our schools don’t teach our children how to best handle money. Thus, you must teach your children how to master these skills. With more and more young teenagers making money, it is your responsibility as a parent to make sure that your child handles it the right way. Kids saving habits is an important habit to instill in your young one. But exactly, why is it important?

Importance of Teaching Your Kids Saving Habits

It is much easier to teach a child than it is an adult. In fact, reports show that children as young as three years old are capable of grasping financial concepts such as saving and spending. Furthermore, researchers at the University of Cambridge proved that kids saving habit are formed by age 7.

So, don’t wait till they get older for you to start teaching them these skills. The sooner you can start teaching them, the better because they can start making smart decisions at an early age. Plus, teaching them these skills makes them immune to social pressures of spending.

First of all, teaching kids saving habits will give them the necessary tools to become financially free. As a parent, you never want to see your children working so hard only to earn the minimum wage, then spend it all on the new supreme sneakers. That’s why you work hard to try and give them a better life than the one you had. It would be a shame for you to give them a fortune only for them to squander it all.

Reasons why we save as adults it to help give us a cushion when faced with an emergency, retirement, investing, and education for our young ones. The sooner your child realizes these truths, the sooner they become financially free.

Statistics have shown that generational wealth is usually lost by both the second and third generation. Simply because these children were not exposed to the right saving habits. So, teach your children the right ways to save, and they will never step out of these teachings.

Secondly, saving helps your child to develop budgeting skills. Budgeting is one of the most important money management skills out there. If your child allocates a certain amount of money to saving, the amount left can be used for other things. Teaching them this principle at an early age will help them to apply the same knowledge when they start earning a salary. So, it’s never too early to start teaching your children money saving habits.

How Can Teach and Maintain Kids Saving Habit

Teaching your kids how to save is an important lesson that will impact their lives forever. Here you will find ideas on how to get them on board when it comes to saving. You will also get pointers on responsible spending and investing to ensure their financial success.

Start small

You might think that you cannot teach your kids how to save because you are not wealthy. You could not be more wrong; there are many alternatives when it comes to saving. You must start whether it is with a dollar or one hundred.

Open a bank account

To foster kids saving habit, you might need to start with a piggy bank or a savings jar. As the kids get older, open a bank account at a credible financial institution. Sign them up for internet banking or mobile banking so they can monitor their account. This will help them retain the excitement of their contributions.

Establish short term goals

Kids saving habit is encouraged easily by short term gratification. Children might have a hard time understanding why they will need money for a house. Helping them save for something so abstract may pose a challenge, and they will soon lose interest. Therefore start by telling them to save for the doll or toy car they would like. This short term goal will ease their transition to long term goals.

Make it fun

Delayed gratification is worse in kids as it is in adults. Therefore, find savings challenges that the kids can adhere to. You can also fit in rewards if they achieve the desired outcome. This will keep them on track of things and reduce boredom. You can also do the challenge together or in the competition to bond through the experience.

Emphasize the time value of money

Teach your kids how compounding works. You can show them how it works by incorporating a real-life test. There is the ‘doubling pennies’ experiment which is an excellent tool for making them understand. In this experiment, you put a penny on one checker box, and you double it up every day.

Kids can quickly learn through real-life examples, which is a great place to start.

Introduce budgeting for older kids

Money management is one of the must-have skills in today’s era. Too many people do not have the discipline to manage their spending and therefore end up not saving. You can easily employ ways to help them understand the difference between needs and wants. Then show them how to prioritize their needs.

This may pose a bit of a challenge at first, but with time, they will get to understand the concept of kids saving habit.

Be a good example

Being a financial role model is the easiest way to show your kids the importance of saving. If you have good financial practices, chances are your kids will adopt the same skills. Be a positive reinforcement of saving for short term and long-term goals, and they will follow suit. Make sure you engage them in the budgeting, planning and saving practices.

Verdict

Every parent uses different approaches when it comes to saving. There are a lot of methods to incorporate to help your child save. There is no one size fits all procedure, therefore do not hesitate to be creative.

Different households allow a certain level of exposure when it comes to financial matters of the family. You can draw the line up to where it seems appropriate. However, involving your kids in family savings and spending will expose them to very fundamental lessons of saving and investment.

References

News On 6. (2020). Teaching children importance of saving money. Retrieved from https://www.newson6.com/story/5ea3939fd795682ab682e618/teaching-children-importance-of-saving-money

Rowland, P. (2020). Photo. Retrieved from https://www.newson6.com/story/5ea3939fd795682ab682e618/teaching-children-importance-of-saving-money

Read More

How Much Should I Save for My Child's College Education?

It’s no secret that the cost of college is continuing to rise. So how much should families save for higher education? Let’s do a deep dive.

It’s no secret that the cost of higher education is continuing to rise. According to Education Data’s research, the average cost of college tuition in the U.S. is $35,720 per student per year.

As if that weren’t enough, college costs increase at an annual growth rate of 6.8%. To put this into perspective, the average interest on a savings account is 0.05%. Yikes!

Parents have multiple financial goals to juggle. From paying off the mortgage to saving for your retirement, there are several things that take priority. Still, it’s smart to think about your child’s college education expenses before that bill comes due. By planning ahead, you can continue to set your child up for success without breaking the bank.

Follow the Order of Operations for Saving for College

Before I do a deep dive into how much to save and where to save it, I want to explore parents' financial priorities.

Most of us learned the order of operations in algebra class. PEMDAS (or “Please excuse my dear Aunt Sally”) is an acronym that tells us the correct sequence of steps to solve a math equation. If we follow this sequence, we will correctly solve the equation, assuming our calculations are correct.

Well, the folks over at The College Investor have come up with an order of operations when it comes to saving for college education.

The key phrase is Y.E.S, and it is something that I think all parents should consider taking to heart.

Y.E.S stands for:

Once your financial house is in order, it’s time to talk about how much you should really save for your child’s college.

How to Determine How Much to Save for College

While we know that the average cost of college is $35,720 per year per student, that’s only part of the equation. This number combines the averages for in-state, out-of-state, private, and public universities, which have widely varying costs. It also doesn’t factor in inflation (will the current 6.8% continue?) or any potential scholarships and grants your child may receive.

Each family is different, with unique circumstances and goals. Below are some different trains of thought. Pick the strategy that seems like the best fit, and then commit to saving for your child’s future.

Fidelity has developed an equation to help parents stay on track to cover half (50%) of the cost of a public 4-year college. They’ve dubbed this equation the “college savings 2K rule of thumb.”

It works like this:

Your child’s age x $2,000 = how much you should have saved.

For example, if your child is 5 years old, then 5 x $2,000 = $10,000. This means that you should ideally have $10,000 set aside for college by the time your child is 5. Again, this equation only assumes that you are paying 50% of the cost of a public 4-year program.

In a mathematically perfect world, this would mean setting $2K aside per year.

But don’t forget about the order of operations we talked about earlier. You might not be in a place to set aside $2K per year right now. That’s ok! You can always make catch-up contributions later on and don’t forget that a 529 Plan itself is an investment account that can accrue its own earnings.

The premise of the ⅓ Rule is that most people don’t pay for major expenses in one large sum (think: your car or house). Instead, the cost is spread out over a long period of time.

When it comes to college savings, the ⅓ Rule suggests that ⅓ will come from:

Past income (savings and/or 529 Plan)

Current income (when your child is in college)

Scholarships, grants, student loans

For the sake of simplicity, let’s say your child’s tuition costs $100,000 over the course of 4 years. According to the ⅓ Rule, $33,333 would be from:

Of course, the ⅓ Rule is a rough estimate. Some parents will have to save more, and some will inevitably save less. However, it is still an interesting breakdown to consider.

This is an easy-to-remember formula that the Lumina Foundation developed. The Rule of 10 suggests that:

Families save 10% of their discretionary income

Families do this for a period of 10 years

Students work 10 hours a week while in college

Discretionary income is usually defined as your after-tax income after all your basic expenses and financial obligations are handled. These priorities should also include your own retirement.

If the $2K Rule, ⅓ Rule, or Rule of 10 doesn’t seem right, there’s nothing wrong with just putting away as much as you can into a 529 Plan or savings account. With this method, decide what to save based on what you can afford, but remember to take care of YOU (Y.E.S.) first! Investing regularly as soon as you are able is key to success!

Types of Accounts to Save for College Tuition

It’s not just how much you save, but where you save it. Again, each family’s goals and circumstances are different, so it’s difficult to recommend the perfect savings vehicle. Still, saving money “imperfectly” is much better than not saving at all. Consider the different types of accounts below, and if you still have questions, I recommend getting in touch with your financial advisor.

No matter how young or old your child is, it’s never a bad time to start thinking about college savings. Making the right plan for your child’s future includes making sure that you know all the options available to you, so I sincerely hope that this post helps you on your journey!

References

tbm™|The Budget Mom. (2021). How much should I save for my child’s college education? Retrieved from https://www.thebudgetmom.com/how-much-should-i-save-for-my-childs-college-education/

Read More

How To Teach Your Kids Good Money Habits

As a parent, you want the best for your children. This doesn’t necessarily mean you want them to have the best clothes, the latest toys or coolest gadgets. Most likely, it means you want them to be safe and secure. And you want to lay a foundation that they can build upon to do well in life.

The question, then, is whether you’re teaching your children a key lesson that will impact whether they will do well. That lesson is about money.

“Without a working knowledge of money, it is extraordinarily difficult to do well in life,” says Sam X Renick, co-creator of Sammy Rabbit, a children’s character and financial literacy initiative. “Money is central to transacting life, day-in and day-out. Where we live, what we eat, the clothes we wear, the car we drive, health care, education, child-rearing, gift giving, vacations, entertainment, heat, air-conditioning, insurance—you name it, money is involved.”

Yet, plenty of parents aren’t helping their kids become financially literate. T. Rowe Price’s 11th Annual Parents, Kids & Money Survey found that nearly half of parents said they miss opportunities to talk to their kids about money and finances. And a quarter said they are very reluctant or extremely reluctant to discuss financial topics with their children.

Kids, on the other hand, are eager for their parents to share their wisdom. Half of the children surveyed said they wish their parents taught them more about money.

Even if you’re not teaching your kids, they will learn lessons about money one way or another. If you want to play a key role in shaping your children’s feelings, thinking and values about money, you need to give them the gift of financial literacy from an early age. Here’s how.

Start With the Basics at a Young Age

Renick has been teaching kids about money through his Sammy Rabbit storybook character since 2001. He has found that the earlier you start a child’s financial education process, the better. Lessons should begin before age seven, he says, because research shows that money habits and attitudes are already formed by then.

Once your kids are old enough to know they shouldn’t be sticking pennies in their mouths, you should introduce them to coins and cash. Explain what money is and how it is used. Actually, showing them how money works is more effective. So let them see you making purchases with cash.

Even if you pay with a debit or credit card, explain to your kids that you’re using your money to make purchases. Chase Peckham, director of community outreach for the San Diego Financial Literacy Center, did this with his son and daughter when they were preschool age. When they shopped together, Peckham would show his kids receipts with the amount he paid. “By doing it over and over again, it became habit to them,” he says. “As they got older, they started to understand. That’s how we introduced money.”

Peckham says that his son understood how money worked by the age of 4, thanks to the receipt strategy. He had more trouble getting through to his daughter. But, by being consistent, he knew that “the light bulb would turn on” for her—and it did.

Instill a Habit of Saving

Your kids’ early interactions with money will likely involve spending. They see you using it to purchase things, including things for them. So it’s important to teach them from a young age that money isn’t just for spending—they should be saving money regularly, too.

Learning to save isn’t just an essential money habit. “Saving teaches discipline and delayed gratification,” Renick says. “Saving teaches goal-setting and planning. Saving stresses being prepared. Saving builds security and independence.”

Help your kids get in the habit of saving by giving them a piggy bank or savings jar where they can deposit coins or cash. Then use short, simple messages to encourage your kids. Renick offers these examples:

With young kids, though, you’ll likely have more luck teaching them to save for short-term goals—such as a toy they really want—rather than for the future, says Tim Sheehan, co-founder and CEO of Greenlight, a debit card for kids with parental controls. The father of four says that encouraging his kids to set short-term goals when they were little helped them learn the value of delayed gratification. As they have gotten older, they are now able to save for longer-term goals.

Parents also can encourage their kids to save more by agreeing to match the amount they save dollar for dollar or by a certain percentage. If your children are old enough to advance from a piggy bank to a real bank, you could take advantage of a service such as Greenlight or FamZoo. These prepaid debit cards and apps allow parents to transfer money to their kids and pay them interest—at a rate of their choosing—on any of the money the kids choose to stash in savings.

Create Opportunities to Earn Money

Kids need to have money of their own so they can learn how to make decisions about using it. An allowance can accomplish that. However, you should consider requiring your kids to do certain chores to earn their allowance. “Just about everyone values money they earn differently than money they receive,” Renick says.

Both Peckham and Sheehan say they wanted their children to learn that money is earned. There are some chores the kids have to do without pay because they’re expected to help out as part of a family. But if they want to get paid, they have to complete certain tasks.

Sheehan says his two youngest children who are still at home get a weekly allowance in an amount equal to their ages. Peckham did that initially with his kids but says they now get a “salary” that is deposited directly into their bank accounts each month. His kids have negotiated raises for their salaries by agreeing to take on additional jobs around the house, he says.

Help Kids Learn to Make Smart Spending Decisions

In addition to wanting his kids to understand that money is earned, Sheehan introduced an allowance system so they could learn to live within a budget. His two youngest children, who are 16 and 11, would constantly ask for money and “spend like drunken sailors,” Sheehan says. When he started paying them an allowance, he told them that was all the money they would get and that it was up to them to manage it.

“Amazingly, it worked,” he says. They track how much they have coming in and going out and how much they’re saving using the Greenlight app. Learning how to budget now will help them when they enter the real world, Sheehan says.

Peckham has allowed his kids to make decisions about their money since they first started earning an allowance. He gave them three jars for spending, saving and giving. Peckham told his kids they had to put some of their allowance in each jar but didn’t specify how much. The decision was up to them.

Peckham also is teaching his kids that spending isn’t always about buying things you want. He wants them to learn that they will have to spend money on things they need when they’re adults and can make the choice to pay people to do things for them. So if his kids don’t do certain things they’re expected to do to help out around the house, it will cost them.

In essence, they’re paying their parents to do those things for them. And the money comes out of their allowance. “I wanted them to make decisions about what they were willing to pay for and what they weren’t,” he says. “I want them to realize, for every choice they make, there will be a repercussion. Personal finance is about decisions.”

Show Kids the Value of Giving

A key reason that it is important for you, as a parent, to teach your kids financial lessons is because you can share your money values through those lessons. If you value giving to others, you can instill that value in your children by helping make it a habit for them from an early age.

You could do as Peckham did with his kids when they were little and create spending, saving and giving jars. The Greenlight and FamZoo apps allow kids to create giving accounts. Or you could help your kids set up a special savings account for giving.

Then help your children plan their giving by discussing what groups or causes they want to support. They can visit CharityNavigator.org to find highly rated organizations.

Teach Kids How Their Money Can Grow

Saving money is a great habit. But if you want your kids to learn how to truly build wealth, teach them about investing, Sheehan says. “I’ve tried to pass on this knowledge and insight to my kids,” he says.

All four of his children have custodial investment accounts he set up for them (minors can’t open their own accounts). Sheehan started teaching his two oldest children, who are 20 and 18, when they were young about how they could invest their money and see it grow at a faster rate. He’s still working to get his younger two children to understand. “Some are ready for it at a young age,” Sheehan says. “Some maybe a little bit later.”

If you don’t understand investing well, you could give your kids a book that explains how it works. Renick says his father introduced him to the personal finance classic The Richest Man in Babylon when he was 12 or 13. “That book really motivated me to want to invest and spend less than I earned,” Renick says.

You can help children get started investing by opening a custodial account with a brokerage such as Charles Schwab, E*TRADE, Fidelity or Stockpile. And Greenlight will start offering an investment option with its accounts later this year.

Model Good Financial Behavior

Just as important as the lessons you teach your kids about money are the ways you discuss and handle money when you’re around them. For example, if you complain about having to spend too much on certain things and then take your kids on a shopping spree, you’re sending mixed messages.

Instead, make sure you model the behaviors around money that you want your children to adopt. Renick says that not only would his father encourage him and his brothers to do work around the house, but also he would jump in and help them out.

“Some of my favorite childhood memories are of having my father assist me washing cars and cutting grass,” Renick says. “He would also use those experiences to talk to my brothers and me about the importance of work and managing our money. He would share things like, ‘It is not how much you make, but what you do with what you make, that makes a difference.’”

If you want your children to develop good spending and saving habits, they need to see you making smart spending and saving choices. In short, practice what you preach. And preach with consistency. Educating your children about personal finance is a process that can take time. But if you put in the effort and continuously communicate a clear message about money, you will instill good habits that will serve your children well.

Cameron Huddleston / Contributor

Cameron Huddleston is an award-winning journalist with nearly 20 years of experience writing about personal finance. She also is the author of Mom and Dad, We Need to Talk: How to Have Essential Conversations With Your Parents About Their Finances.

References

Huddleston, C. (2020). How to teach your kids good money habits. Retrieved from Teach Your Kids Good Money Habits – Forbes Advisor

Getty. (2020). Image. Retrieved from Teach Your Kids Good Money Habits – Forbes Advisor

Read More

Erasing Student Debt Makes Economic Sense. So Why Is It Hard to Do?

By Alana Semuels

Her $90,000 in student debt trailed Jill Witkowski Heaps for decades, like a pesky private eye, as she moved from New York to Fort Myers to New Orleans to Annapolis, always hovering to remind her of her negative net worth.

And then one day, while sitting in a coffee shop near Buffalo, she learned it was gone. “Congratulations!” the email from her loan servicer, FedLoan, said. “You qualify for loan forgiveness.” Her balance was now $0. First, Heaps cried. Then she texted her husband. Then she logged onto the FedLoan website to make sure the email wasn’t some sort of cruel joke.

“It was like I won the lottery,” says Heaps, a 43-year-old environmental lawyer whose loans were forgiven under the Public Service Loan Forgiveness program, which is supposed to allow people who work for nonprofits or the government to wipe out their loans after making 120 payments over 10 years. The program is a boon, but in reality, a tiny fraction of the people who applied for the program have received forgiveness.

The sheer balance of student loans in the U.S.—around $1.6 trillion, up from $250 billion in 2004—has made student-debt forgiveness a popular idea among politicians like Senators Elizabeth Warren and Chuck Schumer, who introduced a resolution in February calling on President Joe Biden to cancel up to $50,000 for people with federal student-loan debt. Biden has said he is prepared to forgive $10,000 in debt for individuals with federal student loans.

The idea is controversial—people who have successfully paid off their loans say it’s not fair to erase the debt of others who weren’t as fiscally responsible. Plus, widespread forgiveness is expensive—the Warren/Schumer plan could cost as much as $1 trillion.

"I didn't get married because I didn't want to have anybody saddled with my debt."

Sharie Zahab

But the scope of the economic crisis created by the pandemic, and the fact that borrowers who graduated before 2007, like Heaps, have weathered two massive financial downturns in their professional careers, is bolstering the argument that major fixes are needed. Although student-loan forgiveness did not make it into the American Rescue Plan passed by Congress, the bill does include a provision to make college-loan forgiveness tax-free until Dec. 31, 2025, eliminating an important barrier that would make it easier to implement broader forgiveness in the future.

Heaps’ story suggests that forgiveness could be good for the economy in the long run. Once she wasn’t paying $700 a month toward her loans, which still totaled $36,395 when they were forgiven, Heaps and her husband had enough money for a down payment on what she calls their “forever” home, which they moved into in February. She can finally provide her 4-year-old son with some stability and the confidence that he’ll be able to stay in the same school system for as long as the family wants. His parents started a college savings plan for him, in the hope he’ll avoid the kind of debt that plagued Heaps for so long.

Research indicates that Heaps’ experience isn’t unique. One study of people whose loans were canceled when the lender lost important paperwork found that the borrowers, freed from the inertia that often accompanies debt, were more likely than other people to move, change jobs and see pay raises.

Since the first pandemic-era stimulus package was enacted in March 2020, millions of Americans have been able to experience life free of the crippling burden of student-loan payments. The CARES Act paused payments on federal student loans and set a 0% interest rate on those loans through September 2020; the Biden Administration has extended that pause until September 2021, affecting some 42 million borrowers.

“Having the payment suspension is very helpful,” says Persis Yu of the National Consumer Law Center (NCLC). “But it makes them kind of realize what it might be like to not have student loan debt at all.”

Jill Witkowski Heaps was able to buy a house after her student loans were forgiven

"I feel like my financial life has finally begun."

For decades, young people were told that a college education was the surest path to achieving the American Dream. But as wages have stagnated, many former students who took out loans to pay for school are finding that the well-paying jobs they expected to land have disappeared. The burden falls hardest on Black and Latino students, who are more likely to take out loans than white peers.

For every person like Jill Witkowski Heaps, there are dozens like Sharie Zahab, who graduated from law school in 2000 with about $83,000 in federal and private loans. She now owes about $121,000 because of various pauses in payments, which allowed interest to accumulate.

Zahab, 48, has weathered three recessions, in 2001, 2008 and 2020, and has been laid off multiple times. She could have qualified for the Public Service Loan Forgiveness program, since she worked for Legal Aid after law school, but lost that job during the Great Recession. When she found work again at a firm representing landlords, she was no longer in public service and thus ineligible for the program.

Whether borrowers get to pause payments on their loans is sometimes random, as Zahab found after she was laid off again in June 2020. She thought she was receiving a pause on her loans because of the CARES Act, only to learn that her federal loans fall under the Federal Family Education Loan Program, which means they are held by private companies and not eligible for the federal pause.

Read more: ‘I Feel Like I’ve Gotten Trapped in This Loan.’ The Peril of Private Student Loans

She then tried to enroll in an income-based repayment program but says her loan servicer, Navient, made it difficult, demanding a certified letter from the state’s unemployment office proving she was jobless. This was the same office that was so overwhelmed with unemployment claims and tech issues at the start of the pandemic that millions of people couldn’t access unemployment benefits. “They gave me the worst runaround for months—I literally called them crying,” says Zahab.

Zahab’s debt has prevented her from living the life she wanted. “I didn’t get married because I didn’t want to have anybody saddled with my debt,” she says. “I didn’t have kids because of it. It basically controlled my entire trajectory.” (High student-loan debt has been shown to harm women’s chances of marriage.) Zahab says she would love to leave her legal career behind and teach, if she could only escape her debt. She’s not alone in feeling professionally constrained; a 2017 study found that holders of student debt were less choosy in the job market and more likely to accept suboptimal jobs that were part-time or in a field that didn’t interest them.

Zahab’s experience highlights the problem of programs that are supposed to help people but that are nearly impossible to access. One federal income-driven repayment program bases monthly costs on a borrower’s income and forgives debt after 20 years of payments. But just 32 of the roughly 2 million people who might have been able to qualify for the program had their loans forgiven, according to a recent report from the Student Borrower Protection Center and the NCLC. Part of the problem is that the private companies servicing loans steered borrowers away from such programs, according to multiple lawsuits. The government also allows people who believe they have been defrauded by private for-profit colleges to apply to have their loans forgiven. On March 18, the Department of Education said it was streamlining that process for 72,000 such borrowers who were denied full relief during the Trump Administration.

Zahab was finally able to enroll in an income-based repayment program in February, lowering her monthly payments from $934 to $53. She’ll have to make payments for two decades before her remaining debt is forgiven.

Heaps says her experience was similarly infuriating. Over the years, she spent hours on the phone with different servicers as her loan was transferred from one company to another; they often gave her incorrect information, she says. At times, she didn’t think she’d succeed, and in fact her application was denied in October 2019. A manager at the loan servicer told Heaps that the Education Secretary at the time, Betsy DeVos, would have to sign off on her forgiveness application personally.

The hassle made her more determined than ever. “I was like, ‘I am going to outplay you; you are not going to get me to go away,'” Heaps tells me.

The experiences of Zahab and Heaps underscore why blanket forgiveness can seem appealing. Rather than force individuals to jump through countless hoops, why not just wipe out a portion of everyone’s loans, as Warren and Schumer proposed? But that may not be equitable, because those who have the highest level of debt forgiven tend to be those with advanced degrees, who are earning high incomes. A better idea, advocates say, would be to make it simpler for everyone to access income-based forgiveness programs. One such program, Revised Pay as You Earn, or REPAYE, lets borrowers pay 10% of their discretionary income; after 25 years of payments, or 20 years for people who took out loans for undergraduate study, the remaining debt is wiped out.

A number of lawsuits are attempting to make it easier for borrowers to learn about and access those forgiveness programs. A February settlement between Massachusetts attorney general Maura Healey and the Pennsylvania Higher Education Assistance Agency (PHEAA), which does business as FedLoan Servicing, requires PHEAA to restore borrowers’ progress towards loan forgiveness if errors caused them to get off track. After a class-action lawsuit filed by members of the American Federation of Teachers, the loan servicer Navient agreed in October to help steer more borrowers toward loan-forgiveness opportunities.

Read more: The Poor Are Getting Poorer as Creditors Pursue Debts During the Coronavirus Crash

There might be a way to cut servicers out of the process entirely, says Matthew Chingos, who runs the Center on Education Data and Policy at the Urban Institute. This would eliminate the conflict of interest inherent in having private loan companies, which are tasked with collecting payments, being trusted to advise people who want to escape those loans. Instead, payments could be taken out of debt holders’ paychecks, the way taxes are, with the IRS’s share rising or falling according to an individual’s income. “We want to get into a system where people who are really struggling and are in an economic crisis don’t have to worry about it,” Chingos says. “Kind of like [the government] has been doing, saying, ‘This is a crazy time, you don’t have to pay your student loans.’ But in a more targeted way, forever.'”

Of course, income-based repayment programs don’t fix the system that got so many people so deep into debt in the first place. But until the wages that come after an education can match the cost of loans, forgiveness is one way to ensure that Americans trapped in student-loan debt and prevented from buying homes, saving for retirement and starting businesses will be able to join the economy.

Both Zahab and Heaps started with law degrees and mountains of debt; because of twists of fate, Zahab’s debt has grown while Heaps’ has disappeared. If Zahab hadn’t been laid off from her public-service job, she might also be debt-free instead of facing down decades of payments. As Heaps would tell her, getting debt wiped out is life-changing. “It opened the possibilities of different things I could spend my money on,” says Heaps, who no longer has a negative net worth. “I feel like my financial life has finally begun.”

–With reporting by Alejandro de la Garza

References

Semuels, A. (2021). Erasing student debt makes economic sense. So why is it so hard to do? Retrieved from https://time.com/5951766/student-loan-forgiveness-challenges/

Ryan, D. L. (2021). A graduate crosses the red carpet at Boston College’s commencement. The Boston Globe/Getty Images. Retrieved from https://time.com/5951766/student-loan-forgiveness-challenges/

Read More

U.S student debt has ballooned to $1.7 trillion. Here's what President biden and lawmakers can do to help

Student debt in the U.S. has ballooned to over $1.7 trillion since Congress first allowed college students to borrow from the government in 1958.

This debt has varying effects on students, workers and the larger economy.

How the student debt crisis ballooned to $1.7 trillion

"We see the student debt crisis when it comes to individual student loan borrowers. We see how student loan borrowers struggle to save for retirement, to have emergency savings, to buy houses, to start small businesses," Student Borrower Protection Center former executive director Seth Frotman told CNBC.

In the last few years, though, activists from both sides of the aisle have called for the president to do something about student debt.

Many have even pushed for outright cancellation.

"It is abundantly clear that under a statute called the Higher Education Act, the president of the United States has the legal authority to cancel federally owned student debt," said Rep. Mondaire Jones, D- N.Y.

How much you need to invest each month to save $2 million by the time you turn 40

Some argue that debt cancelation isn't the answer and would mostly benefit wealthier borrowers who don't have a problem paying off their loans on time.

"If I were to say to you, would you borrow one hundred thousand dollars to go to Harvard Law School, you wouldn't blink and say yes, that's clearly a good deal," Wellesley College economics professor Phil Levine said. "We shouldn't be absolving those people off their debt.

They made an enormous investment that's going to pay off, really, a lot."

President Joe Biden has been largely silent about a plan to broadly cancel student debt since taking office, even though he campaigned on canceling up to $10,000 in student debt for all borrowers.

However, his administration has absolved some student debt for certain groups like borrowers with disabilities and active duty service members.

Watch the video below to learn more about the origins of the student debt crisis, the different options the president has explored to cancel it and the many proposals about how to fix the system for the future.

Marquez. A. (2021). U.S. student debt has ballooned to $1.7 trillion. Here's what President Biden and lawmakers can do to help. Retrieved from U.S. student debt has ballooned to $1.7 trillion. Here's what President Biden and lawmakers can do to help (msn.com)

Read More